SEASONAL BUSINESS FUNDING

The problem is, seasonal businesses often lack the cash flow they need to pay their business expenses. Companies going into a peak season must have the working capital to purchase inventory and hire seasonal personnel. As companies exit the peak season, they are required to pay vendors at a time when their working capital is much less. Waiting 60 or 90 days for your invoices to receive payment means your season could be over before still no payment for supplies you bought at the start! And, getting a traditional bank loan for a seasonal business is not always easy: they require a steady monthly payment regardless of whether you experience a slow season.

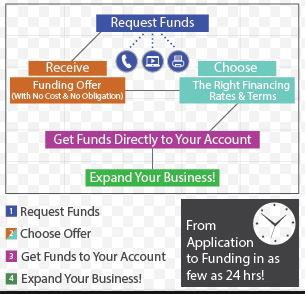

Fortunately, ShurrFinancial can help. With deep experience in providing Receivables Financing and Purchase Order financing to sellers of seasonal products and services, we understand that a seasonal business faces peak and slow seasons. We offer specific programs designed to meet the needs of seasonal businesses. We can solve your cash flow crunch and help you grow through to year’s end.